I've seen a lot of positive feedback online recently with regard to ESL's DAY TRADING SOFTWARE.

I have been using ESL Day Trading Software since 2003. ESL DT7.0 is a fantastic piece of software but it is not easy to learn. There are a couple of books published which go into the formula writing etc by Howard Bandy which aren't too bad. The beauty of ESL DT7.0 is it is very customizable and the processing speed is incredible, the range of formulas you can experiment with seems to know no end. ESL DT7.0 is one of those bits of software which has so many features, most likely you will only use less than 10%. Because of its complexity, I have it now set up in a certain mode and don't venture past that in case I upset my settings. At one point in time I did numerous backtests, in the hundreds, it is extremely fast in that area, but now don't do these as there is not the need. You get to know what does and doesn't work. The strengths of ESL Day Trader 7.0 for me has been the ability to devise great stock scanners and to experiment with trading concepts. The downside is the complexity of learning the formulas. ESL Trading in itself becomes a hobby and the formula writing very much fun once you get it. For new aspiring ESL Trading enthusiasts, I would suggest download some ready made formulas, then study those by going into the formula editor and by playing around and copy and paste you will get a good idea how the code works. I would only recommend ESL DT7.0 if you are a bit of a trading and coding nerd and love designing stuff, otherwise maybe try something else as this software will soak up your time.

ESL Stock Market Trading

Tuesday 13 December 2011

Monday 5 December 2011

ESL TRADING YEAR IN REVIEW

Wow...2011 hasn't been a year for the faint-hearted.

Our premier share index, the S&P/ASX 200, closed at 4745 points on December 31 last year and as of last Friday November 25 had fallen to 3984. A whopping 16% loss of market value (excluding dividends).

False Hope, Dashed

The market worked hard for the first 7 weeks of the year, driving to a high of 4939, before plunging to 4480 (almost 10%) just under a month later. We recovered quickly; hitting the year high in the second week of April, but that was to be the brightest spot of 2011.

The trend has been pretty ugly since, and we're off around 20% since that mid-April peak.

Not only has the year been tough overall, but the gyrations of the market have been enough to provoke bouts of sea-sickness even in the toughest of market veterans. Regular movements (up and down) of 1 and 2% weren't - unfortunately - unusual.

With that said let's take a look at the best and worst performing stocks of 2011.

Five of the Best from 2011

As we draw towards the end of 2011, as of November 25 the S&P/ASX 200 index is down 16% compared with the end of last year. It's been a tough year in anyone's language, and few companies have been spared the mood of pessimism that has pervaded the market, largely unchecked, since 2008.

The U.S. housing bubble that burst precipitated a wave of bank collapses, credit freezes and the international banking sector rediscovered a prudence that had been missing for the previous decade or so. Government debt that had been built on the promise of a better tomorrow became toxic when tomorrow didn't bring the expected riches.

That said, some companies have had a wonderful 2011, despite the overall market pessimism and economic lethargy. Here are five ASX 200 companies soundly beating the index so far this year:

Bouncing Back

One of the big winners from 2011 so far is Sigma Pharmaceuticals (ASX: SIP.ax). The pharmaceutical wholesaler has had a tough couple of years, with the convergence of tougher retail competition, ever increasing pressures on government pharmaceutical benefits funding and declining demand for its consumer brands.

Sigma is still a long way from its 3-year high of $1.28, but a program of divestments, cost controls and reduced customer trading terms has stopped the bleeding, and the share price has recovered from a low of $0.30 in April.

A Good Year To Be A Miner

Miners have been thick among the top performers in 2011. A combination of growing demand and strong mineral prices has been a boon for mining companies. Beach Energy (ASX: BPT.ax) has been the recipient of that and more, with strong reserves and commercialisation plans for its deposits and a geographic spread throughout Australia, Asia, Africa and North America.

Resolute Mining (ASX: RSG.ax) shareholders have been enjoying a strong run for the last three years, from a low of $0.37 in early 2009 to a recent high of $2.14 (an increase of almost 500%) before dropping back in the past couple of weeks. A poster-child for the resources boom, Resolute has gold mining operations in Africa and Queensland, and has a strong exploration program. The strong extraction program and gold price has meant Resolute has been able to both pay down debt and commence a share buyback program.

Patients and Patience – A Good Combination

Shareholders of biotechnology outfit Mesoblast (ASX: MSB.ax) know better than most how volatile the sharemarket has been over the past couple of years. In the past 7 months alone, Mesoblast shares have risen or fallen by over 20% on 6 separate occasions. Still, Mesoblast should perhaps be a case study in the benefits of ignoring short-term market moves, with shareholders being amply rewarded this year alone, and many, many times over in the past three years, with shares up an eye-popping 700% in that time.

Workin' On The Railroad

If you're not making your money from mining, the next best option is to be providing mining-related services.

Newly privatised Queensland-based rail operator QR National (ASX: QRN.ax) was the subject of much debate and disagreement when it was floated around this time last year. Many brokers and advisors were suggesting clients give the company a wide berth, with concerns around returns on equity, profitability and the ongoing capital expenditure plans. In the short-term at least, the QR National bulls have taken the honours, with the shares quickly climbing to $3.59 in April of this year, and fluctuating almost exclusively between $3.00 and $3.50 since.

Foolish Take-Away

Hindsight is clearly 20/20. In a perfect world, we would have had portfolios chock-full of Resolute, Sigma and the like on the first of January, and the year since would have been a much more pleasant experience. Equally, there are miners who are worth much less now than they were on New Year's Day, and turnaround candidates which, well, didn't turn.

It's perhaps unrealistic to be able to forecast which miners or biotechnology companies will have a company-transforming breakthrough and which others fall by the wayside, unless you have particular industry expertise.

However, when Sigma put itself into a net cash position by selling its branded business and Resolute was consistently paying down debt and commencing a share buyback, these might have been signs that better, less risky times were ahead.

Sure, we might have missed the absolute bottom, but there are no extra points in investing for degree of difficulty. There's still plenty of money to be made once a company's plans begin to bear fruit.

Five of the Worst from 2011

I don't have to tell you that 2011 has been a tough year for investors.

As of November 25, the S&P / ASX 200 index is down 16% and if you're like me, your portfolio is a little worse for wear, with a falling market not sparing many companies. When a sentiment of pessimism strikes, even some of the most profitable, best managed companies in the country can't escape the investor gloom.

Adding Insult To Injury

Still, given the ASX 200 is simply an average of its components, many companies do better and many others do considerably worse – by definition.

That means many shareholders are sitting on 2011 losses in some companies that are multiples of the average loss. If you hold some of these companies, I apologise for the reminder.

Little Margin For Error

Sometimes big drops in a share price can come from a previous overvaluation, after investors come to realise they've been expecting too much, and a precipitous share price is the result of a return to normality.

Other times, investors come to understand that the business they're invested in is just a lousy business, and even average multiples are too generous. Lastly, sometimes the company itself simply falls victim to a competitor, a new technology or changing consumer tastes – or finds that it can't execute on its plans.

The businesses below are among those which bore the heaviest brunt of investor dissatisfaction in 2011:

Execution Counts

White Energy (ASX: WEC.ax) has had a terrible run with external parties over the past year, and the share price continues its steady downward trajectory. After cancelling the proposed acquisition of Cascade Coal in March this year, November bought the breakdown of a partnership with an Indonesian partner. White, once hailed for its so-called ‘clean coal' technology is paying the penalty from investors looking for a greater level of certainty, especially in such volatile times.

Another miner on the nose with investors is Murchison Metals (ASX: MMX.ax). The company has interests in two key infrastructure projects in Western Australia, which have suffered from both cost over-runs and project delays.

The Crosslands and Oakajee Port and Rail projects are transformative developments, but their sheer scale meant the ongoing issues with the projects were seen by some investors as risking the whole company. The announcement last week of the sale of these projects to Mitsubishi (pending certain conditions being met, including shareholder approval) has seen the share price jump almost 50%, but still well off its 2011 highs.

Tough Economics

Warren Buffett once said "when a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is usually the reputation of the business that remains intact". Both BlueScope Steel (ASX: BSL.ax) and OneSteel (ASX: OST.ax) find themselves squarely in the 'bad economics' category.

Both companies are in the steel manufacturing business, buying expensive minerals from mining companies, feeding the raw materials into incredibly expensive infrastructure and selling a largely commoditised product into a global market where they compete with international manufacturers who most often have significantly lower conversion costs.

Accordingly, with little control of either the costs or selling price and with a commoditised product with little to no brand premium, these two businesses find themselves largely at the mercy of the prevailing winds.

A Turnaround That Hasn't Turned

Tasmanian timber business Gunns (ASX: GNS.ax) is nothing if not a business under siege, and the headlines aren't getting any better. One of the largest employers in many parts of the Apple Isle, Gunns has long been a target for environmentalists looking to put an end to its logging and pulp mill operations. This pressure has continued to grow as Gunns tried to commission a new pulp mill, with local and global financial institutions being pressured not to supply funding to Gunns for the development.

With sales and profits falling, long suffering shareholders have seen the price fall from a high of $3.65 only four years ago to be sitting at only $0.17 last Friday.

Foolish Take-Away

Warren Buffett isn't the most successful investor in our history for nothing. Sometimes, no matter how hard management tries, the dynamic with its customers, competitors and suppliers makes the task more than Herculean. In those cases, investors are well advised to stay clear and focus on more attractive opportunities. So too, with turnaround candidates and ‘big bet' strategies.

When the companies manage to pull them off, investors can be amply rewarded. However, the business and investing landscape is littered with the stories of those who tried and failed – and that's where Buffett's rule number 1 – "don't lose money" – should be at the front of every investor's mind.

Our premier share index, the S&P/ASX 200, closed at 4745 points on December 31 last year and as of last Friday November 25 had fallen to 3984. A whopping 16% loss of market value (excluding dividends).

False Hope, Dashed

The market worked hard for the first 7 weeks of the year, driving to a high of 4939, before plunging to 4480 (almost 10%) just under a month later. We recovered quickly; hitting the year high in the second week of April, but that was to be the brightest spot of 2011.

The trend has been pretty ugly since, and we're off around 20% since that mid-April peak.

Not only has the year been tough overall, but the gyrations of the market have been enough to provoke bouts of sea-sickness even in the toughest of market veterans. Regular movements (up and down) of 1 and 2% weren't - unfortunately - unusual.

With that said let's take a look at the best and worst performing stocks of 2011.

Five of the Best from 2011

As we draw towards the end of 2011, as of November 25 the S&P/ASX 200 index is down 16% compared with the end of last year. It's been a tough year in anyone's language, and few companies have been spared the mood of pessimism that has pervaded the market, largely unchecked, since 2008.

The U.S. housing bubble that burst precipitated a wave of bank collapses, credit freezes and the international banking sector rediscovered a prudence that had been missing for the previous decade or so. Government debt that had been built on the promise of a better tomorrow became toxic when tomorrow didn't bring the expected riches.

That said, some companies have had a wonderful 2011, despite the overall market pessimism and economic lethargy. Here are five ASX 200 companies soundly beating the index so far this year:

Bouncing Back

One of the big winners from 2011 so far is Sigma Pharmaceuticals (ASX: SIP.ax). The pharmaceutical wholesaler has had a tough couple of years, with the convergence of tougher retail competition, ever increasing pressures on government pharmaceutical benefits funding and declining demand for its consumer brands.

Sigma is still a long way from its 3-year high of $1.28, but a program of divestments, cost controls and reduced customer trading terms has stopped the bleeding, and the share price has recovered from a low of $0.30 in April.

A Good Year To Be A Miner

Miners have been thick among the top performers in 2011. A combination of growing demand and strong mineral prices has been a boon for mining companies. Beach Energy (ASX: BPT.ax) has been the recipient of that and more, with strong reserves and commercialisation plans for its deposits and a geographic spread throughout Australia, Asia, Africa and North America.

Resolute Mining (ASX: RSG.ax) shareholders have been enjoying a strong run for the last three years, from a low of $0.37 in early 2009 to a recent high of $2.14 (an increase of almost 500%) before dropping back in the past couple of weeks. A poster-child for the resources boom, Resolute has gold mining operations in Africa and Queensland, and has a strong exploration program. The strong extraction program and gold price has meant Resolute has been able to both pay down debt and commence a share buyback program.

Patients and Patience – A Good Combination

Shareholders of biotechnology outfit Mesoblast (ASX: MSB.ax) know better than most how volatile the sharemarket has been over the past couple of years. In the past 7 months alone, Mesoblast shares have risen or fallen by over 20% on 6 separate occasions. Still, Mesoblast should perhaps be a case study in the benefits of ignoring short-term market moves, with shareholders being amply rewarded this year alone, and many, many times over in the past three years, with shares up an eye-popping 700% in that time.

Workin' On The Railroad

If you're not making your money from mining, the next best option is to be providing mining-related services.

Newly privatised Queensland-based rail operator QR National (ASX: QRN.ax) was the subject of much debate and disagreement when it was floated around this time last year. Many brokers and advisors were suggesting clients give the company a wide berth, with concerns around returns on equity, profitability and the ongoing capital expenditure plans. In the short-term at least, the QR National bulls have taken the honours, with the shares quickly climbing to $3.59 in April of this year, and fluctuating almost exclusively between $3.00 and $3.50 since.

Foolish Take-Away

Hindsight is clearly 20/20. In a perfect world, we would have had portfolios chock-full of Resolute, Sigma and the like on the first of January, and the year since would have been a much more pleasant experience. Equally, there are miners who are worth much less now than they were on New Year's Day, and turnaround candidates which, well, didn't turn.

It's perhaps unrealistic to be able to forecast which miners or biotechnology companies will have a company-transforming breakthrough and which others fall by the wayside, unless you have particular industry expertise.

However, when Sigma put itself into a net cash position by selling its branded business and Resolute was consistently paying down debt and commencing a share buyback, these might have been signs that better, less risky times were ahead.

Sure, we might have missed the absolute bottom, but there are no extra points in investing for degree of difficulty. There's still plenty of money to be made once a company's plans begin to bear fruit.

Five of the Worst from 2011

I don't have to tell you that 2011 has been a tough year for investors.

As of November 25, the S&P / ASX 200 index is down 16% and if you're like me, your portfolio is a little worse for wear, with a falling market not sparing many companies. When a sentiment of pessimism strikes, even some of the most profitable, best managed companies in the country can't escape the investor gloom.

Adding Insult To Injury

Still, given the ASX 200 is simply an average of its components, many companies do better and many others do considerably worse – by definition.

That means many shareholders are sitting on 2011 losses in some companies that are multiples of the average loss. If you hold some of these companies, I apologise for the reminder.

Little Margin For Error

Sometimes big drops in a share price can come from a previous overvaluation, after investors come to realise they've been expecting too much, and a precipitous share price is the result of a return to normality.

Other times, investors come to understand that the business they're invested in is just a lousy business, and even average multiples are too generous. Lastly, sometimes the company itself simply falls victim to a competitor, a new technology or changing consumer tastes – or finds that it can't execute on its plans.

The businesses below are among those which bore the heaviest brunt of investor dissatisfaction in 2011:

Execution Counts

White Energy (ASX: WEC.ax) has had a terrible run with external parties over the past year, and the share price continues its steady downward trajectory. After cancelling the proposed acquisition of Cascade Coal in March this year, November bought the breakdown of a partnership with an Indonesian partner. White, once hailed for its so-called ‘clean coal' technology is paying the penalty from investors looking for a greater level of certainty, especially in such volatile times.

Another miner on the nose with investors is Murchison Metals (ASX: MMX.ax). The company has interests in two key infrastructure projects in Western Australia, which have suffered from both cost over-runs and project delays.

The Crosslands and Oakajee Port and Rail projects are transformative developments, but their sheer scale meant the ongoing issues with the projects were seen by some investors as risking the whole company. The announcement last week of the sale of these projects to Mitsubishi (pending certain conditions being met, including shareholder approval) has seen the share price jump almost 50%, but still well off its 2011 highs.

Tough Economics

Warren Buffett once said "when a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is usually the reputation of the business that remains intact". Both BlueScope Steel (ASX: BSL.ax) and OneSteel (ASX: OST.ax) find themselves squarely in the 'bad economics' category.

Both companies are in the steel manufacturing business, buying expensive minerals from mining companies, feeding the raw materials into incredibly expensive infrastructure and selling a largely commoditised product into a global market where they compete with international manufacturers who most often have significantly lower conversion costs.

Accordingly, with little control of either the costs or selling price and with a commoditised product with little to no brand premium, these two businesses find themselves largely at the mercy of the prevailing winds.

A Turnaround That Hasn't Turned

Tasmanian timber business Gunns (ASX: GNS.ax) is nothing if not a business under siege, and the headlines aren't getting any better. One of the largest employers in many parts of the Apple Isle, Gunns has long been a target for environmentalists looking to put an end to its logging and pulp mill operations. This pressure has continued to grow as Gunns tried to commission a new pulp mill, with local and global financial institutions being pressured not to supply funding to Gunns for the development.

With sales and profits falling, long suffering shareholders have seen the price fall from a high of $3.65 only four years ago to be sitting at only $0.17 last Friday.

Foolish Take-Away

Warren Buffett isn't the most successful investor in our history for nothing. Sometimes, no matter how hard management tries, the dynamic with its customers, competitors and suppliers makes the task more than Herculean. In those cases, investors are well advised to stay clear and focus on more attractive opportunities. So too, with turnaround candidates and ‘big bet' strategies.

When the companies manage to pull them off, investors can be amply rewarded. However, the business and investing landscape is littered with the stories of those who tried and failed – and that's where Buffett's rule number 1 – "don't lose money" – should be at the front of every investor's mind.

Thursday 1 December 2011

It's all in the mind..

On the surface, trading looks like any other skill that a person learns and becomes proficient in. All a trader has to do is to apply the methodology he or she has learned and risk is managed. But the actual performance of trading is different. There are many traders who know how to trade when risk of loss is not involved, but fall apart when their knowledge is put to the test when trading "live".

The first blunder a trader makes is to assume that the mind and emotion are separate from one another. Many traders are advised by well-meaning teachers to "leave their emotions at the door" when they trade. Just how do you do this

You don't. But traders have a tendency to maintain a deception where they believe they are capable of this. The belief "feels" right and is not reality tested. The "feeling" right (more about this later) and a sense of certainty clouds the mind - no matter what evidence is presented to the contrary. This is called cognitive dissonance. Then comes the collision between these ungrounded beliefs (rooted in the feeling of certainty) and their performance in trading.

Beliefs, no matter how much they "feel" right, are severely tested for effectiveness in trading. Many people act from beliefs that are never put to the test until they get into trading. And then they are confronted with the observation that the beliefs that they bring to trading do not allow them to move from a certainty-based mindset to a probability-based mindset. And without a probability-based mindset, dealing with the uncertainty involved in trading will trigger fear as the emotional base for thinking while trading.

The brain has deceived the trader's mind. The brain was never designed to separate uncertainty from fear. But it is designed to produce a sense of certainty, even if the assumption is wrong, so that the brain does not have to experience the discomfort of uncertainty. To the brain, uncertainty is fused with the fear of death. This is where most traders stay stuck.

Tuesday 29 November 2011

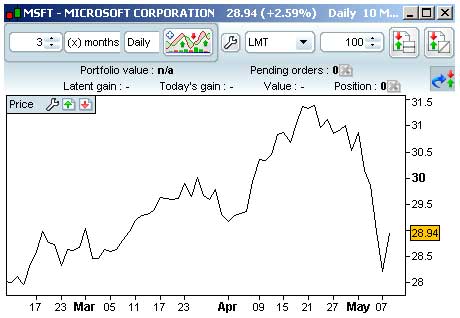

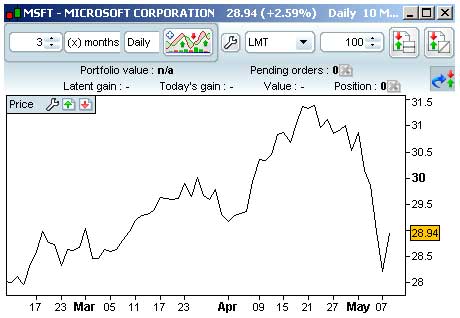

STOCK MARKET CHARTING

Stock market charts are an easy-to-read graphical representation of the past price performance. Looking at the chart is one of the first steps in analyzing stocks, to get the very first filling how successfully the company is running its business; in more advanced technical analysis charts are used to identify the stock market trends, trend changes, price variations, institutional trading and many other such critical measures.

While there are many different types of stock market charts available in financial analysis, three of them are most commonly used: the most basic line chart and two more advanced, bar and candlestick chart.

The most basic type of stock market charts is the line chart, which is connecting the stock's closing price over the timeframe. The most often viewed timeframe for stock charts is daily period. If we are looking at a daily chart, the closing price for each day is plotted and connected by a single line from one day to the next; for weekly charts, the closing price for the week is used, and when looking at monthly charts, the closing price for the month is used.

The most basic type of stock market charts is the line chart, which is connecting the stock's closing price over the timeframe. The most often viewed timeframe for stock charts is daily period. If we are looking at a daily chart, the closing price for each day is plotted and connected by a single line from one day to the next; for weekly charts, the closing price for the week is used, and when looking at monthly charts, the closing price for the month is used.

Line charts are very easy to read and understand. They are usually used over longer time scales to present a stock movement and to help you determine the current trend. Line charts are not used for predicting possible future movement of the stock, since they don't provide any information about the trading range during each time frame; they only show you one piece of information and that is the closing price of the period.

It is also possible that line chart is connecting the open, high or low prices over the timeframe, but this is rare, since the closing price is considered to be the most important price of stock data. You have probably heard that amateurs are opening the market, while professionals are closing it.

A more complex type of chart is the bar chart. It expands information of each data point to the open (O), high (H), low (L) and close (C) price in the given period. That is why this type of stock market charts is also called OHLC charts.

A more complex type of chart is the bar chart. It expands information of each data point to the open (O), high (H), low (L) and close (C) price in the given period. That is why this type of stock market charts is also called OHLC charts.

A bar is a vertical line for each time frame, presenting the price range between the minimum (low) and maximum (high) price for the time period being displayed. On the left side of vertical line there is a small horizontal dash, which is showing the stock opening price. On the right side of the vertical line there is also a small horizontal dash, but this one is presenting the stock closing price.

Bar charts can be colored to show whether the price rose during the timeframe (green) or fell (red). If the left dash representing the open price is lower than the right dash representing the close price, the bar is colored green, because the stock has gained in its value and vice versa.

Investors and traders use this type of stock market charts for more in depth technical research, since there is a lot more information available in bar than in line charts. You are able to see the trading range of the timeframe and not only the closing price. This additional piece of information can help you determine typical volatility of the stock in given time frame and it clearly tells you who won the battle in that specific period, the bulls or the bears.

Candlestick charts originated as a form of Japanese charting and are similar to bar charts. Each candle consists out of the body and the shadows. The length and position of the candle body determines the open and closing prices of the stock and shadows represents the stock's high and low values similar to the bar chart. The weekly candlestick for example represents Monday's open, the weekly high-low price range, and Friday's closing price.

Candlestick charts originated as a form of Japanese charting and are similar to bar charts. Each candle consists out of the body and the shadows. The length and position of the candle body determines the open and closing prices of the stock and shadows represents the stock's high and low values similar to the bar chart. The weekly candlestick for example represents Monday's open, the weekly high-low price range, and Friday's closing price.

The body of the candle is usually colored depending on the day's price action. A candle body is colored with red when the closing price is lower than the opening price. When the closing price is higher than the opening price, it is usually displayed with a green solid body. Other colors and fills are also possible (black and white for example), depending on your charting program - there is unfortunately no standard for use of colors in this area.

While bar and candlestick types of stock market charts are very similar in presenting the same piece of information (open, high, low, close), there is one clear advantage of candlesticks over bars - colored candle bodies are much easier to read, thus letting you feel the market much more quickly.

Looking at charts can take a lot of your time. On your way to professional investing consider ordering a professional tool for charting; it can save you a lot of time and money.

While there are many different types of stock market charts available in financial analysis, three of them are most commonly used: the most basic line chart and two more advanced, bar and candlestick chart.

Line Chart

Line charts are very easy to read and understand. They are usually used over longer time scales to present a stock movement and to help you determine the current trend. Line charts are not used for predicting possible future movement of the stock, since they don't provide any information about the trading range during each time frame; they only show you one piece of information and that is the closing price of the period.

It is also possible that line chart is connecting the open, high or low prices over the timeframe, but this is rare, since the closing price is considered to be the most important price of stock data. You have probably heard that amateurs are opening the market, while professionals are closing it.

Bar Chart

A bar is a vertical line for each time frame, presenting the price range between the minimum (low) and maximum (high) price for the time period being displayed. On the left side of vertical line there is a small horizontal dash, which is showing the stock opening price. On the right side of the vertical line there is also a small horizontal dash, but this one is presenting the stock closing price.

Bar charts can be colored to show whether the price rose during the timeframe (green) or fell (red). If the left dash representing the open price is lower than the right dash representing the close price, the bar is colored green, because the stock has gained in its value and vice versa.

Investors and traders use this type of stock market charts for more in depth technical research, since there is a lot more information available in bar than in line charts. You are able to see the trading range of the timeframe and not only the closing price. This additional piece of information can help you determine typical volatility of the stock in given time frame and it clearly tells you who won the battle in that specific period, the bulls or the bears.

Candlestick Chart

The body of the candle is usually colored depending on the day's price action. A candle body is colored with red when the closing price is lower than the opening price. When the closing price is higher than the opening price, it is usually displayed with a green solid body. Other colors and fills are also possible (black and white for example), depending on your charting program - there is unfortunately no standard for use of colors in this area.

While bar and candlestick types of stock market charts are very similar in presenting the same piece of information (open, high, low, close), there is one clear advantage of candlesticks over bars - colored candle bodies are much easier to read, thus letting you feel the market much more quickly.

Which Type of Chart Should You Use and When?

Each type of chart has its own benefits and drawbacks. Learning about each type and their capabilities will enable you to choose the right one based on your trading style. I personally recommend using simple line charts for quick historical review of a stock's price and when you advance to more detail research, you should move to bar or candlestick charts. Remember, the shorter your investment horizon is, the more important become advanced OHLC charts; I personally prefer candlestick charts over bar charts, since they combine the ability to show complete information for each timeframe with a shape that is much simpler and clearer to read.Looking at charts can take a lot of your time. On your way to professional investing consider ordering a professional tool for charting; it can save you a lot of time and money.

Monday 28 November 2011

Economists doubt Budget Surplus Forecasts

Economists doubt the federal budget will return to surplus because the savings are not large enough and growth forecasts are too optimistic.

The federal government said it would meet its target for a budget surplus in 2012/13 after making new savings worth $11.5 billion over four years to make up for a shortfall in revenue caused by deteriorating global economic conditions.

In its Mid-Year Economic and Fiscal Outlook (MYEFO) published on Tuesday, the government projected a surplus of $1.5 billion for the 2012/13, which was less than its May budget forecast for a surplus of $3.5 billion for that financial year.

Nomura Australia chief economist Stephen Roberts said the surpluses were too small when you considered the deficit blowout of $14.5 billion in the past six months.

"From the budget in May, in six months we've gone from a prospective budget deficit of $22.6 billion, to $37.1 billion (for this financial year)," Mr Roberts said.

"Anything could happen to the 2013/14 budget because the latest estimate the budget surplus for 2013/14 is only $1.9 billion.

"There's significant risks we could have a pretty sizable deficits persisting in 2012/13 and 2013/14."

JP Morgan chief economist Stephen Walters said cuts in spending to return the budget to surplus could hurt the economy.

"A more than plausible case can be made for the government to let the budget remain in deficit, as insulation against an even deeper global downturn and exaggerated weakness in the domestic economy," Mr Walters said.

"As far as government officials are concerned, though, the politics argue against this.

"On today's evidence, the government will be tightening fiscal policy materially as the economy weakens.

"Cutting spending now carries significant risks; the cuts could, for example, undermine already fragile consumer and business sentiment," he said.

Federal Treasury also cut its forecast for gross domestic product (GDP) growth from four per cent to 3.25 per cent in 2011/12.

RBC fixed income and currency strategist Michael Turner said the forecasts appeared too optimistic.

He said RBC's GDP growth forecasts were significantly lower, at 2.6 per cent for 2011/12.

"We doubt the government will be able to deliver such rapid fiscal consolidation in one year," Mr Turner said.

"We do, however, expect that the attempt will still provide a material contractionary fiscal pulse. With growth prospects having worsened over the course of this year."

CMC Markets chief market strategist Michael McCarthy said the budget statement seemed to reveal dampened expectations for growth.

"There's also a concern here that this has been a bit of a weak reaction - that the $11.5 billion cuts over the next four years ... could be withdrawing stimulus at a time when fiscal stimulus is an important part of the overall economic equation," he said.

The federal government said it would meet its target for a budget surplus in 2012/13 after making new savings worth $11.5 billion over four years to make up for a shortfall in revenue caused by deteriorating global economic conditions.

In its Mid-Year Economic and Fiscal Outlook (MYEFO) published on Tuesday, the government projected a surplus of $1.5 billion for the 2012/13, which was less than its May budget forecast for a surplus of $3.5 billion for that financial year.

Nomura Australia chief economist Stephen Roberts said the surpluses were too small when you considered the deficit blowout of $14.5 billion in the past six months.

"From the budget in May, in six months we've gone from a prospective budget deficit of $22.6 billion, to $37.1 billion (for this financial year)," Mr Roberts said.

"Anything could happen to the 2013/14 budget because the latest estimate the budget surplus for 2013/14 is only $1.9 billion.

"There's significant risks we could have a pretty sizable deficits persisting in 2012/13 and 2013/14."

JP Morgan chief economist Stephen Walters said cuts in spending to return the budget to surplus could hurt the economy.

"A more than plausible case can be made for the government to let the budget remain in deficit, as insulation against an even deeper global downturn and exaggerated weakness in the domestic economy," Mr Walters said.

"As far as government officials are concerned, though, the politics argue against this.

"On today's evidence, the government will be tightening fiscal policy materially as the economy weakens.

"Cutting spending now carries significant risks; the cuts could, for example, undermine already fragile consumer and business sentiment," he said.

Federal Treasury also cut its forecast for gross domestic product (GDP) growth from four per cent to 3.25 per cent in 2011/12.

RBC fixed income and currency strategist Michael Turner said the forecasts appeared too optimistic.

He said RBC's GDP growth forecasts were significantly lower, at 2.6 per cent for 2011/12.

"We doubt the government will be able to deliver such rapid fiscal consolidation in one year," Mr Turner said.

"We do, however, expect that the attempt will still provide a material contractionary fiscal pulse. With growth prospects having worsened over the course of this year."

CMC Markets chief market strategist Michael McCarthy said the budget statement seemed to reveal dampened expectations for growth.

"There's also a concern here that this has been a bit of a weak reaction - that the $11.5 billion cuts over the next four years ... could be withdrawing stimulus at a time when fiscal stimulus is an important part of the overall economic equation," he said.

Sunday 27 November 2011

ESL Investments

ESL Investments

ESL Investments is a privately owned hedge fund based in Greenwich, Connecticut and estimated to be worth over $9 billion as of 2004.[1] ESL Investments are not associated with ESL International, the stock market investment technology company. The fund is managed by Edward Lampert, who found it in April 1988 and named it after his initials. The firm invests in the American public equity and hedging markets. Managing the fund with a contrarian investing approach, Lampert is the company's chairman and chief executive officer, and William Crowley is its president and chief operating officer.[2] ESL is fairly unique as a hedge fund in that it takes large stakes in a small number of companies and holds them for many years.[3] Most of ESL's portfolio consists of retail companies, particularly Kmart (now Sears Holdings Corporation), by far the company's largest holding (53.5% ownership as of June 2010).[4] The revenue from Kmart plays a big part in helping ESL acquire other companies.[1]

Lampert found the fund in 1988 with initial outside investments worth $28 million. Since then, the fund has had returns averaging 29% a year. His clients include David Geffen, Michael Dell, the Tisch family (owners of Loews Corporation), and the Ziff family (owners of Ziff Davis).[1] In 2004, the fund made Lampert the first hedge fund manager ever to make more than $1 billion in a year, when the fund grew 69%, following his decision to buy Kmart and merge it with Sears.[5] At the start of the financial crisis of 2007–2010, however, ESL's retail holdings were severely affected due to a drop in consumer spending, and the company's investment in Citigroup in September 2007 saw a significant drop in value since the fund made its investment.[6] Lampert has sometimes been called "the next Warren Buffett" due to the similarities between both of their investing styles, especially that of concentrated value. Through the fund, Lampert is worth approximately $2 billion.[1] Lampert, who typically invests in undervalued stocks, is known to have modeled his investing style on Buffett's style by analyzing his annual shareholder letters.[3]

Thursday 24 November 2011

ESL Trading Software

About ESL (Engineering Software Lab Ltd):

Founded in August 2005, ESL (Engineering Software Lab Ltd) is an Israel-based technical software reseller and professional services company focused on Source Code Analysis, Security, Software Engineering and Development Components. We offer end-to-end solutions that include software, project and consulting services, integration and implementation services, and training. A Parasoft Software Elite Partner, ESL resells and offers certified consulting services for Parasoft's Automatic Error Prevention (AEP) product lines. In addition, ESL is an authorized Parasoft Support Partner, providing responsive, local software support for Parasoft's AEP solutions. ESL is also a certified reseller for Wolfram Research's Mathematica product line.

In addition to partnering with Parasoft Software and Wolfram Research, ESL has established strategic vendor partnerships with various other Software vendors, among them Cenzic,(our solution for Web Applications Security) Objective Systems, SubMain, TeamF1, Armorize (see full vendors list here), and interoperate to provide support for the entire application development lifecycle. ESL also has R&D department that develops and markets technologies that are complementary to its vendor products.

ESL is maintaining and supporting deployment of Open Source products in its areas of expertise, typical example is the Frama C project.

ESL's executive team has a wealth of combined industry knowledge, making the company a dominant player in the Israeli enterprise software quality and development markets. Our team has acquired extensive experience by helping Israeli companies and clients worldwide integrate product development processes departmentally across the enterprise.

At ESL, our team is committed to providing full lifecycle support for developing, testing and delivering market-driven products. From capturing and validating requirements to product testing to ensure that requirements have been met, ESL's focus is on helping customers manage and deliver the highest value products possible.

ESL's executive team has a wealth of combined industry knowledge, making the company a dominant player in the Israeli enterprise software quality and development markets. Our team has acquired extensive experience by helping Israeli companies and clients worldwide integrate product development processes departmentally across the enterprise.

At ESL, our team is committed to providing full lifecycle support for developing, testing and delivering market-driven products. From capturing and validating requirements to product testing to ensure that requirements have been met, ESL's focus is on helping customers manage and deliver the highest value products possible.

Subscribe to:

Posts (Atom)